Introduction

The renewable energy industry is making a huge impact on the Indian industrial & commercial sectors; both sectors are opting for solar energy to reduce the cost and carbon footprint.

When choosing the right solar model, the two names that come to an individual’s mind are Capex Solar and Opex Solar. Both have their unique differences, advantages, and disadvantages that must be weighed carefully depending on specific needs and goals.

In this blog, we will discuss which model is the best for you and why it suits you the most.

Understanding Opex and Capex in Solar Models

What is Capex Solar?

An Opex model typically involves no or very low upfront costs for installing solar panels on your property.

In the Opex Model, a third party buys the solar panels and takes on all the installation and upfront costs, and in exchange, as the consumer, you have to pay a fixed monthly fee to essentially “lease” the solar equipment, usually based on how much electricity it produces for your business. This fee is typically lower than what you’d normally pay your utility provider.

The OPEX model is appropriate for individual consumers who are skeptical about making long-term capital investments in technology they have less understanding of.

What is Opex Solar?

Capex Solar refers to an upfront investment made by an individual or company, involving the installation, operation, and maintenance of solar panels on your facility’s rooftop or available ground space. The entire system becomes your company’s asset, giving you complete control over its operation and the energy it produces.

The Capex Model also comes with tax and depreciation benefits, along with the ability to send excess energy back into the grid and receive compensation for it.

Consumers who want to save money on the Capex Model should contact EPC (Engineering, Procurement, and Construction) installers to install a rooftop solar system via this model, as any excess electricity generation can be fed into the grid, saving time and reducing overall project costs.

Difference Between Capex Model and Opex Model in Solar

1. Cost Comparison

- Capex Solar: This model has more upfront expenses, such as installation charges, servicing charges, and operating costs. However, it’s a one-time investment because, unlike Opex solar, you don’t have to pay monthly usage charges.

- Opex Solar: In this model, there are zero or minimal upfront charges. This model saves the installation charges, servicing charges, and operating costs, which are incurred by the owner of the solar plant in exchange for a monthly fee.

2. Risk & Maintenance

- Capex Solar: In Capex Solar, since you are the owner, you have to bear maintenance for regular cleaning, inverter replacement, monitoring, and servicing, and the risk of equipment performance, breakdowns, and efficiency loss during or after installation.

- Opex Model: In Opex Solar, the solar service provider takes on most risks, including equipment failure and underperformance, and also all operations, monitoring, and servicing are handled by the provider at no extra cost to the consumer.

3. Flexibility & Scalability

- Capex Solar: With a Capex solar model, flexibility largely depends on the owner’s budget and willingness to reinvest. Since you fully own the system, you can upgrade or expand it, whether that means adding more panels, integrating battery storage, or upgrading to more efficient inverters.

-

- Opex Solar: The Opex Solar model offers more operational flexibility and scalability without requiring extra upfront investment. Since the system is usually owned and maintained by the provider, customers can negotiate capacity upgrades or extensions as their energy demand grows. This makes Opex especially attractive for fast-growing businesses, commercial complexes, or industries that may need additional solar capacity within a short time.

People also read: Open Access in Solar Parks: Driving the Shift to Sustainable Energy

Capex vs Opex Solar in 2025: Key Factors to Consider

| Capex Solar | Opex Solar |

| Initial investment is very high. | Initial investment is minimal or zero. |

| Return on investment is 15-20%. | Return on investment is not applicable. |

| The payback period is around 3-4 years. | Immediate savings, as there is no investment cost. |

| Creates an asset for the company. | Creates expenses for the company. |

| The system control is in our hands. | The system control is as per the PPA terms. |

| Any technological risks are faced by the company. | No risks are faced, as it is the developer’s responsibility. |

| The financial risks are initially high, which becomes low with time. | The financial risks are initially low, which becomes moderate with time. |

| In the long term, there are overall better returns. | In the long term, there are predictable savings. |

Benefits and Challenges of Capex and Opex Solar Models

Benefits and Challenges of Capex Solar

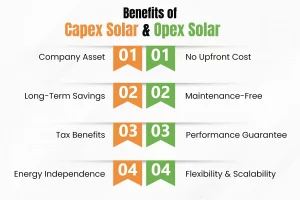

Benefits of Capex Solar:

- Company Asset: Once the solar plant is installed, its whole control and ownership are given to the company.

- Long-Term Savings: After the upfront investment has been recovered, the owner gets 20-25 years of electricity for zero to minimal cost.

- Tax Benefits: Many governments in 2025 continue to offer tax credits, accelerated depreciation, and other incentives for owned solar systems.

- Energy Independence: Ideal for organizations and homeowners who want full control and independence from external providers.

Challenges of Capex Solar:

- High Upfront Investment: Requires significant capital expenditure, which may not be feasible for everyone.

- Maintenance Responsibility: The whole responsibility of maintenance is of the business, as it is the asset of the business.

- Long Payback Period: The initial payback period of the investment can be around 4-8 years, which can be considered long by some people.

- Limited Liquidity: Tying up capital in solar reduces funds available for other investments or business operations.

Benefits and Challenges of Opex Solar

Benefits of Opex Solar:

- No Upfront Cost: No need for any upfront investments; you only pay for the amount of energy you use.

- Maintenance-Free: The maintenance and operational costs are taken care of by the owner of the solar plant.

- Performance Guarantee: Many Opex contracts include guaranteed energy output, shifting risk away from the customer.

- Flexibility & Scalability: Easy to expand capacity as energy needs grow, without additional capital investment.

Challenges of Opex Solar:

- No Ownership: You don’t get the ownership of the solar plant, as it is the provider’s property.

- Long-Term Dependency: You are tied in a contract with the provider, which has a duration of 10-25 years.

- Cumulative Cost: Over decades, total payments may exceed the cost of outright ownership under Capex.

- Less Control: Upgrades, modifications, or relocations require negotiation with the provider.

Choosing the Right Model for Your Business in 2025

When deciding between Capex and Opex solar models in 2025, the right choice depends on your financial capacity, long-term goals, and risk appetite. Both approaches deliver clean energy, but they serve different needs.

Capex solar, on the one hand, is a great investment that can be a great asset for the business for the next 20-30 years. But it has a big upfront investment, which not everyone is able to afford.

On the other hand, Opex Solar is a great idea if you want to save money while using solar energy from someone else’s solar plant. But it does not provide anything to the business and becomes an expense for the company.

So, now if you are someone who can afford an investment of 2-3 crore for your company, then it’s best for you to do this investment. But, if you are someone who is not capable of buying a solar plant and still wants to lower their electricity bills, then Opex Solar is the right choice for you.

Conclusion

In 2025, the decision between Capex and Opex solar models ultimately depends on your company’s financial strength and long-term energy goals. The Capex model is ideal if you can handle the upfront investment and want complete ownership, long-term savings, and energy independence. However, it does come with higher initial costs and maintenance responsibilities.

The Opex model, on the other hand, is better suited for businesses that prefer zero upfront costs, immediate savings, and hassle-free operations managed by a third party. While it doesn’t create an asset, it provides flexibility and scalability with minimal risk. By weighing your financial capacity and strategic priorities, you can choose the model that best supports your sustainability journey in 2025.

If you are still confused about which one to consider the best for you, then you can contact Novergy for more reliable information.

FAQs

1. What is the difference between the Capex model and the Opex model?

Ans- In Capex Solar, you fully own the system, and you can upgrade or expand it as you like. However, the Opex Solar model offers more operational flexibility and scalability without requiring extra upfront investment.

2. Why is Capex preferred over Opex?

Ans- Capex provides the whole ownership of the solar plant, its operation, and control; this is why Capex is preferred over Opex.

3. What is the difference between CAPEX and the RESCO solar model?

Ans- In the Capex model, the rooftop owner makes the capital investment and owns the solar system, while in the Resco model, all upfront costs are covered by a third-party developer. In India, the Capex model remains the most widely adopted approach for solar deployment, thanks to its long-term savings and asset creation benefits.